Income Tax India

Everyone who earns or gets an income in India is subject to income tax. Your income could be salary, pension or could be from a savings account that’s quietly accumulating an interest, Renting of House Properties, Gain on Sale of Capital Assets, Business Income or Loss, Other Incomes.

How Can Helps RBCS

We have a Tax Expert Team to helping out to filing of Income Tax Return as above mentioned income, When you connected with us, our team will be help finding the way where can minimized the Tax Liabilities with authentic and as per income tax law.

Note:- Last Chance of Filing Return Previous FY 2018-19 (Last Date Extended to 30th November)

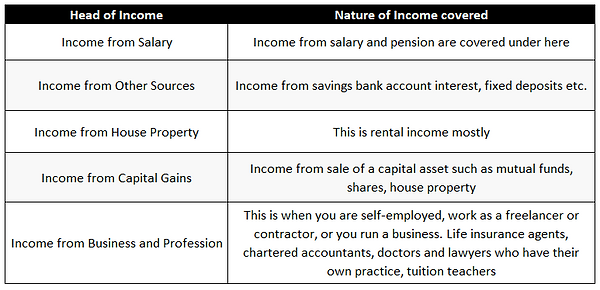

The Income Tax Department breaks down income into five heads:

All of these taxpayers is taxed differently under the Indian income tax laws. While firms and Indian companies have a fixed rate of tax of 30% of profits, the individual, HUF, AOP and BOI taxpayers are taxed based on the earned income slab they fall under mentioned. Individuals incomes are grouped into blocks called tax slabs. And each tax slab has a different tax rate. In India, we have four tax brackets each with an increasing tax rate as per income.