INCOME TAX RETURN & TDS

The Income Tax Act, 1961 contains provisions for filling of Return of Income. Return of Income is the format in which the assessee furnishes information as to his total income and tax payable. The format for filing of returns by different assessee is notified by the CBDT. The particulars of income earned under different heads, gross total income, deduction from gross total income, total income and tax payable by the assessee are generally required to be furnished in return of income. In short, a return of income is the declaration of income by the assessee in the prescribed format.

Income Tax Return is the form in which assessee files information about his Income and tax thereon to Income Tax Department. Various forms are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7. When you file a belated return, you are not allowed to carry forward certain losses.

The Income Tax Act, 1961, and the Income Tax Rules, 1962, obligates citizens to file returns with the Income Tax Department at the end of every financial year. These returns should be filed before the specified due date. Every Income Tax Return Form is applicable to a certain section of the Assessees. Only those Forms which are filed by the eligible Assessees are processed by the Income Tax Department of India. It is therefore imperative to know which particular form is appropriate in each case. Income Tax Return Forms vary depending on the criteria of the source of income of the Assessee and the category of the Assessee.

COMPULSORY FILING OF RETURN OF INCOME [SECTION 139(1)]

-

As per section 139(1), it is compulsory for companies and firms to file a return of income or loss for every previous year on or before the due date in the prescribed form.

-

In case of a person other than a company or a firm, filing of return of income on or before the due date is mandatory, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeds the basic exemption limit.

-

Every person, being a resident other than not ordinarily resident in India within the meaning of section 6(6), who is not required to furnish a return under section 139(1), would be required to file a return of income or loss for the previous year in the prescribed form and verified in the prescribed manner on or before the due date, if such person, at any time during the previous year, -

-

holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has a signing authority in any account located outside India; or

-

is a beneficiary of any asset (including any financial interest in any entity) located outside India.

-

However, an individual being a beneficiary of any asset (including any financial interest in any entity) located outside India would not be required to file return of income under this clause, where, income, if any, arising from such asset is includible in the income of the person referred to in (a) above in accordance with the provisions of the Income-tax Act, 1961.

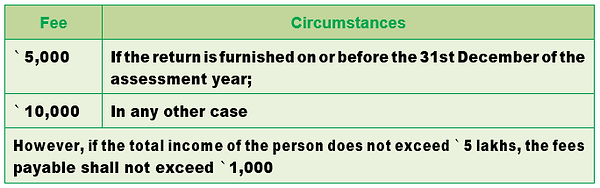

FEE FOR DEFAULT IN FURNISHING RETURN OF INCOME [SECTION 234F]

Where a person, who is required to furnish a return of income under section 139, fails to do so within the prescribed time limit under section 139(1), he shall pay, by way of fee, a sum of–